Nigeria’s headline inflation soared to 33.88% in October, marking a significant uptick from 32.7% the previous month.

The Consumer Price Index (CPI) report from the National Bureau of Statistics (NBS) links this surge to escalating transportation costs and spiralling food prices. At first glance, this development might seem like a grim statistic for policymakers and consumers alike. However, a closer examination reveals profound implications for businesses operating in Africa’s largest economy.

The Weight of Inflation on the Business Ecosystem

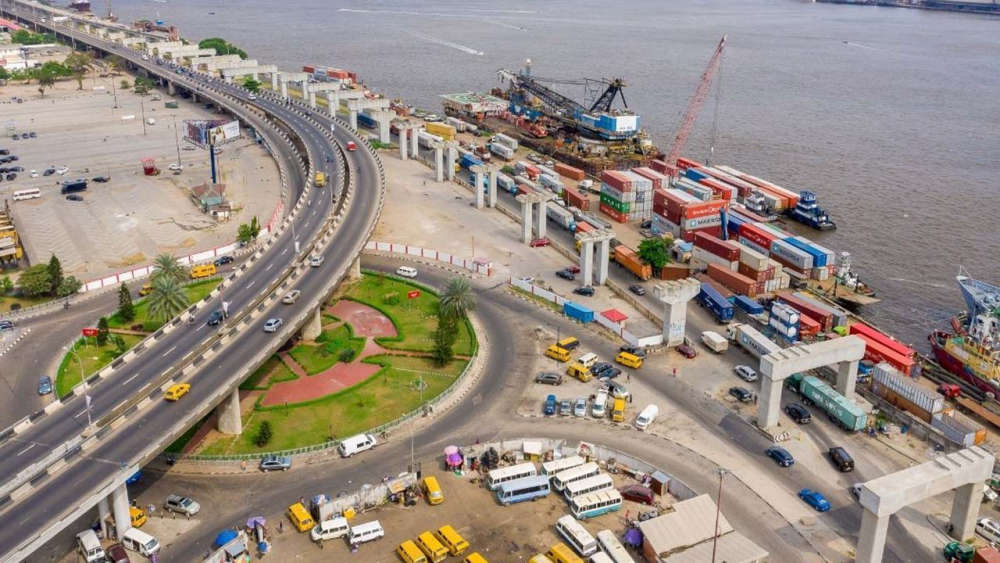

Inflation is a double-edged sword, and for Nigerian businesses, it cuts deeper with each percentage point rise. Higher transportation costs translate to increased logistics expenses for manufacturers and retailers. Food prices, which form a significant component of household consumption, not only squeeze consumer purchasing power but also drive up labor costs as employees demand higher wages to keep up with the cost of living.

Small and medium-sized enterprises (SMEs), the backbone of Nigeria’s economy, are particularly vulnerable. Many operate on thin margins and lack the pricing power to pass costs onto their customers without risking reduced demand. With inflation nearing 34%, SMEs are faced with a grim choice: absorb rising costs or risk alienating price-sensitive consumers.

The Corporate Conundrum

For larger corporations, the challenges are no less daunting. Multinationals and local conglomerates face heightened operational expenses, particularly in transportation-heavy industries like manufacturing, agriculture, and retail. The cost of importing raw materials often pegged to the dollar, becomes even more burdensome as inflation erodes the value of the naira. Companies relying on domestic supplies are not immune either, as local producers grapple with higher input costs.

Moreover, the rise in inflation exacerbates an already precarious credit environment. Borrowing costs, tied to the Central Bank of Nigeria’s monetary policy rate, are likely to increase as the apex bank battles inflation with tighter monetary policies. Businesses relying on loans to fund operations or expansions may find themselves in a liquidity crunch, further stifling growth prospects.

The Consumer Paradox

Nigeria’s vast consumer market, often touted as its economic strength, becomes a liability in times of high inflation. The typical Nigerian household now spends a disproportionate share of income on necessities, leaving little for discretionary purchases. Businesses in sectors like entertainment, luxury goods, and non-essential services may experience a sharp decline in revenues.

Conversely, essential sectors such as food production and pharmaceuticals may see sustained demand but will face intense pressure to keep prices competitive. The agricultural sector, already struggling with post-harvest losses and insecurity, might see further strain, threatening food security and deepening the inflationary cycle.

Opportunities Amidst the Crisis

Despite the bleak outlook, there are opportunities for businesses nimble enough to adapt. Companies that invest in local production to reduce reliance on imports could shield themselves from currency fluctuations. Similarly, leveraging technology to streamline operations and cut costs could offer a competitive edge.

The inflationary environment also presents an opening for fintech startups. As Nigerians seek ways to hedge against currency devaluation, demand for digital savings, investment platforms, and cryptocurrency solutions may grow. Businesses that innovate around affordability and convenience could thrive in these constrained economic times.

A Call for Strategic Action

The government and private sector must act decisively to mitigate the impact of rising inflation. Policies that address structural inefficiencies, particularly in agriculture and transportation, are urgently needed. For businesses, the path forward requires a delicate balance of cost management, innovation, and consumer engagement.

Nigeria’s inflation crisis is not merely an economic statistic; it is a reality reshaping the nation's business environment. For companies, navigating these turbulent times will demand resilience, adaptability, and foresight. Those who succeed will not only weather the storm but emerge stronger, ready to seize the opportunities that lie beyond the horizon.